Will WFH bring about the next financial collapse?

ALSO: 'no one wants to be managed, we want to be inspired'

Demand for office space set to fall by 40%

Hot off the press is some brand new Leesman data about offices and how we are using them. Leesman is a research firm which specialises in understanding our workplaces and their effectiveness. (I’ve frequently covered their work in the past).

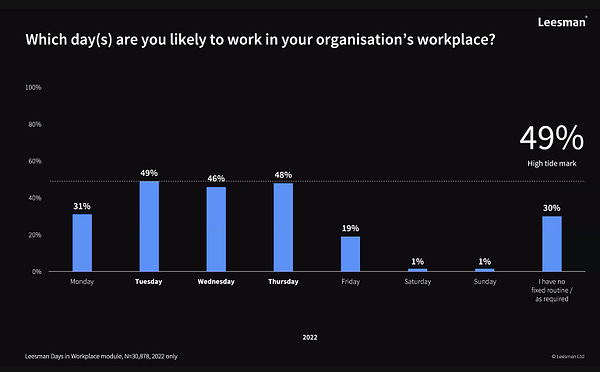

Leesman surveyed 30,000 UK workers to understand how they were using their workplaces. Firstly the day of week usage won’t surprise people:

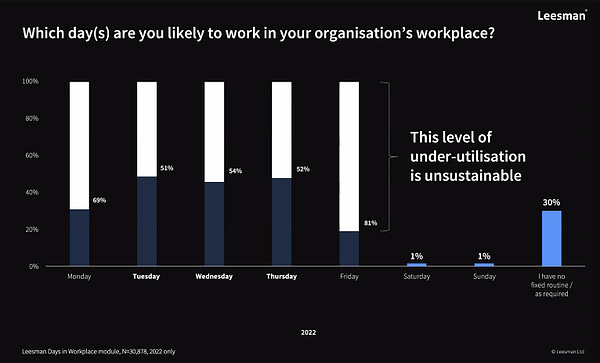

But aside from the day of week index, additionally the total usage of offices on busy days was substantially down. Leesman took a look at the impact of this on overall office usage and declared that it is financially ‘unsustainable’.

Their conclusion is that most firms could reduce their office usage by 40% with no impact on their organisation.

The researchers asked 100 leading commercial real estate decision makers, 69% of whom said they were planning to reduce their office footprint. (29% of the group said they were set for 'substantial' reductions.

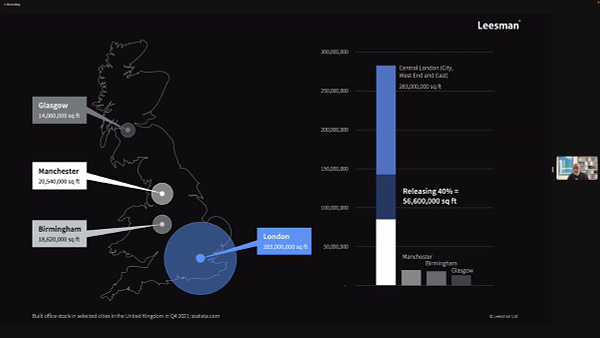

The aggregate impact of this is seismic - if half of firms reduced their office footprint by 40% this would put an astonishing amount of real estate back into the market. London’s office space would be disrupted by as much unused space as Birmingham, Manchester and Glasgow have in use today.

What does this mean for the sector? Does it raise the possibility (as I’ve asked repeatedly) that we’re heading for a 2008 style crash of commercial property?

Earlier this month Bloomsberg reported that some institutional investors have started defaulting on commercial mortgages that are deeply underwater. These loans weren’t an issue during the Pandemic when interest rates were close to zero but as interest rates have risen mortgages that are in substantial negative equity are being abandoned:

“Over the past decade, investors treated offices as though they were bonds. They saw high-quality buildings with long-term leases and ever-rising rents as supersafe... The uncertainty around the future of work has turned office space, an inherently long-term, fixed asset, into an increasingly risky, volatile one”

Over the last week or so, in the aftermath of the collapse of Silicon Valley Bank, establishment voices (like the Financial Times) have attempted to link the institution’s collapse to its remote working policy. The green light for this blame was given when the bank itself had used its annual report to flag that it “may experience negative effects of a prolonged work-from-home arrangement”. The FT reported that the bank’s working arrangements were causing communication problems inside the organisaton.

Whether such policies had an impact on the performance or the culture of the organisation isn’t certain. But it is pretty clear that as an excuse for the bank’s collapse it didn’t pass the sniff test. The bank collapsed because of rash securities investments, not because employees were working from their kitchen tables.

Despite that distraction, the Leesman data heralds the prospect of a genuine risk for a major investment sector. “I don’t think this is The Big Short,” one speculator told Bloomberg. “But there’s going to be a lot of distress in office.”

It’s worth reminding ourselves that the commercial real estate thought leader Dror Poleg has suggested that around 30% of office buildings are suited for repurposing as residential property (the rest would need to be rebuilt). It is estimated that the UK has a shortage of more than 4 million homes.

“Nobody wants to be managed, we all want to be inspired” - interesting piece about the failings of the new ‘tough guy’ approach of the boss of Rolls Royce

Just in case you weren’t following it, Ethan Mollick's Substack remains the best thing on the internet. He's a business lecturer at Wharton learning how to use AI tools for innovation. In this post he shows you how to improve the writing you get from the tools (by getting a food review changed so it appears in the style of Anthony Bourdain). Here he says AI will have a bigger impact than steam power: a study of programmers found that AI improved their productivity by 55%

Worried that a jumpy boss will notice that your ‘active’ light is no longer green? This Mouse Jiggler will keep you looking busy - buy it on Amazon

This episode of the Guardian’s Today in Focus goes in depth to the Four-Day Week experiment (I also previously highlighted the FT’s series on the same topic), what comes across strongly is the sense that these things can’t be entered into lightly but four-day weeks can lead to increased productivity if implemented well

Two dazzling new podcasts for you

Firstly a wonderful discussion about the looming generational conflict at work. Ellen Scott is the deputy digital editor of Stylist and someone who has achieved recognition for having a sharp eye when it comes to observing the changing face of work. Ellen was one of the first voices to pick up on the TikTok trend of Quiet Quitting, she’s written about ‘the ambi-work’ movement and continues to give voice to the challenges facing Gen Z and Millennial workers. We talk about whether is as fair a deal today as it always was, and what firms could do to improve things.

How should we be thinking about the upsides of AI? The second podcast’s guest Professor Costas Andriopoulos explains the relationship between curiosity and creativity at work.

By striving to be curious our minds will surprise us with the creativity that results. We have a wonderful discussion about using AI to drive creativity in our jobs.

Finally, I’m thrilled to have been made an Honorary Visiting Professor at Bayes Business School at City University. I’ve featured many members of the Bayes teaching staff over the years and I’m delighted to be taking a role helping them with their MBA and executive education courses.

Is it possible that rash securities investments were made because employees were working from their kitchen tables?